Bubble Markers

My Friday-The-13th modicum this week is on finance – specifically, how to profit from the stock buy back obsession in corporate America.

Financial bubbles by definition occur when rational processes break down, and runaway irrationality takes hold. You’d think we’d get better at this stuff as society ages and technology improves, but we aren’t. We just wrap the irrationality with layers and layers of complexity that just better hides it from a rational thought. Credit default swaps anyone?

It’s a fascinating concept, the idea of the mind wrapping irrational action with layers of complexity to hide its chaoticness. It’s like the lengthy stories patients with phantom limbs go through to justify why they are not able to manipulate the world with their rationally missing limb. Economic bubbles are a groupthink version of this.

So I can’t help be on the lookout for a sign of a bubble that almost inevitably will arise from a 11 year economic expansion period. (Yes, it need not be a bubble to force an end or be the cause. Our current wholesale selling of future economic growth for immediate unnecessary stimulation is ample ammunition for recession). I’ve trained my mind with markers to indicate where the bubble may be hiding.

These personal “bubble markers” are:

Advertising and Infomercials – When a hype goes overboard to make lots of money fast, there is usually a bubble underneath

Articles on how the old models are no longer relevant – There is an almost humorous persistence in 20 year old financial journalists to be the first to write about how 100s of years of economic common sense is now out of date due to some technology or advancement. I saw one this morning about how unemployment rates above 8% are just no longer going to occur due to technology advancements. I didn’t click just to discourage the click bait.

Should I get in? – When I have more than two unconnected people ask me if I think they should get into some financial scheme, that is nearly a sure fired way to know to run or short. Last time this happened was with Bitcoin.

Government Red Tape. If the government begins to come in to limit, protect or redistribute profit making from an open market, it is another contributing red flag. The government moves so slow though that this has to be responded to quickly.

Divergent graphs. I keep a lookout for those passing graphs that show a strong divergence from past balances. For instance, there are graphs right now on the college loan runaways and corporate debt that show quintessential bubbles in advanced stages. And I’m not even going to link to the QE + Tax Cuts and Jobs Act wholesale giveaway graphs because they are too depressing for our future.

The Graph

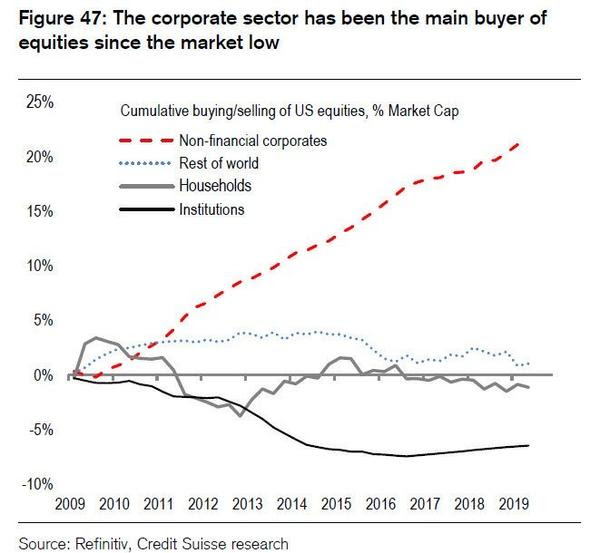

So it’s on this last bubble marker that I ponder this week. Here is a graph I discovered recently.

Boy, that looks like bubble material. (Note: the chart is representing the net % of market cap – so households and the world are adding funds, but just at an increase commenserate to overall growth, keeping them at the same % level)

The numbers are actually staggering. Over 50% of profits by the S&P 500 have been funneled into stock buybacks.

Enterprise value Vs. Equity value

So, just some background info on buybacks.

If I have a company, say Orange, and it has a 100 shares at 10/share making it worth 1,000. Let’s say the company has 750 in cash. Now the company is reasonably worth really only $250 because the investors are already thinking that the $750 in cash is part of their share and will be paid out to them. The promise of a potential dividend is priced into the share price.

So if Orange, instead of a dividend or reinvestment, buys those shares back with that cash, 75 shares go off the market. No new money has been created, no growth, no change in prospect for the business. So in theory the share price should remain the same. There are less shares to be purchased but there is less cash on the books too – cancelling each other out to keep the share value the same.

But it does mean that the percentage of the company that shareholders own increases, giving the 25 share shareholders 100% ownership of the company and thus a perceived increase in value. How interesting – you just created value/money out of thin air.

Because there are less shares, the Earnings per Share and P/E also increases. Bam! two key metrics for a company’s value just got better despite the fact that the company has not changed any business fundamentals. Funnily, the online discussion boards never question the metric – but the metric is flawed because the marketplace assumes that the number of shares in the company is if not constant then at least consistent. Buybacks destroy that.

Also, share price values go up after buyback announcements simply from an emotional response that the company is doing so well that it can’t even figure out enough areas to re invest it’s money in. Or the company feels that the marketplace does not fully appreciate its stock price, so it buys its own stock. Or it buys it back to improve the financial reporting metrics to get it on the top of the search engine lists for roving quant algorithms, most of whom are presumably not programmed to compensate for a flawed metric.

All these reasons seem entirely irrational to me – none are creating new money or indicating (not inferring) a healthy company beyond the existence of the cash in the first place, which is baked into the share price already.

If there is a rational reason for share price inflation after stock buyback, I’d love to know it. The simple supply and demand argument (outside of voting percentage) does hold water to me.

Leveraged buybacks

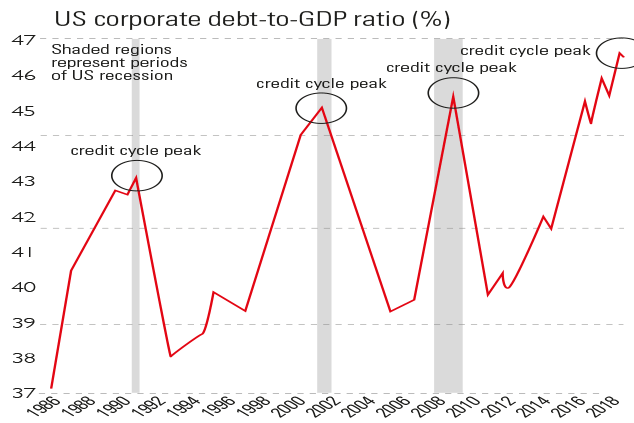

So all of this gets even more crazy when companies borrow money to buy their own stock. Corporate debt is already a staggering 50% of GDP – so companies are fully addicted to low interest rates and loose money to do whatever they want. Recursively re-investing debt into their own stock sounds like the shenanigans of some of the recursively leveraged scenarios of the housing bubble.

And can you believe it?: More than half of all buybacks are with debt.

You get all this irrational – albeit temporary – lift to the share price for free, as long as you can arrange for a good loan rate. Like most leverage schemes, it’s a multiplicative affect that can be used repeatedly to amp up the end result. But multiplication works both ways – it hastens the fall as much as the rise.

So, a Bubble?

So it’s a problem, but is it a bubble?

Here is an article the squarely fits the first bullet of a bubble marker; in particular pay attention to the opening line:

Corporate buybacks are a major driver of stock prices, so it’s no wonder that many investors are bullish that buyback announcements are proceeding at a torrid pace this year.

I read this sentence as “A irrational influence on stock prices has became a major driver of their value, so it is no wonder that irrational investors are bullish to learn that bubble is really taking off now, at a torrid pace”.

Here is another article that hits my “the old models are broken” bubble marker. To its credit, it gives plenty of references to the conversation about buybacks.

So, it might not reach the level of “bubble” as corporate debt, but it clearly is a problem that companies are manipulating the key metrics of their performance. At least their is some discussion on whether it is a healthy thing to allow.

So how to profit?

So my pondering this week is not on if there is a bubble, but how do we profit from it if there is?

Short Buybackers: Obvious thing to do is short the companies buying back their stock. Hey, there are ETFs that specialize just in buying Buy Back companies. Why not just short that?

Well, looking at it — its holdings is pretty much just a subset of the S&P 500. With indexing so dominate, their market cap is already high – and buybacks just inflates it further.

But… that doesn’t sound right from a Black Swan perspective. Any gain from shorting the S&P 500 is surely not large enough for the risk of … well shorting the S&P 500. There are so many other factors that can overwhelm their performance.

Short Leveraged Buybackers: What about just going after those that are really gaming the system – the leveraged buy backers? American Airlines and AT&T look tasty. But timing the market for individual shorts is tricky and costly. As my good friend reminded me of Keynes warning:

The markets can stay irrational longer than you can stay solvent

Keynes

Reward Dividenders: What about rewarding those that are healthy but not participating in the artificial bump of buy backs – the dividend companies? Not as sexy, and likely not as multiplicative as I’d like for a black swan investment.

What else? What will the bubble look like when it bursts? How are buyback prop ups manifesting themselves most weakly? What investment vehicles will have a massive increase when corporate debt collapses? I don’t have a good answer yet (opinions welcome!)

And that is as far as I got with my modicum this week.